Department of Education Toolkit

Top 7 Tools to Help You Navigate the Dept. of Ed Changes

The Department of Education’s recent policy updates are creating uncertainty for families navigating college admissions, financial aid, and planning.

Remember YOU are still in control of your outcome despite any external changes and challenges…and you are not alone! We are here to help.

Along with your free consultation, the Dept. of ED Toolkit includes expert insights, practical strategies, and must-know updates to help you stay ahead and make informed decisions.

Tool #1: 🎯 How To Find The Right Colleges at the Right Price

✅ Easy & Efficient: 4 Steps, 1 Powerful Tool

🔢 Know your Student Aid Index (SAI) – Knowing your SAI is the first step in understanding your aid eligibility Hint: There are 2 SAIs.

🎓 The Truth About Scholarships – Find every scholarship you're eligible for at schools nationwide. Hint: Do not focus on private scholarships. The colleges give the big bucks.

🏫 Know How to Shop Smart – We instantly calculate exactly how much each college will actually cost your family. Hint: Often times the most that appear to be the most ‘expensive’ are actually the most affordable.

💰 1-minute Budget – Answer a handful of questions to see what your college budget is. Hint: You might be pleasantly surprised!

Good News you can do all of this in one place!

Tool #2: Meet With an Expert

💬 Get Personalized Guidance from a College Planning Expert

Book a FREE 30-Minute Consultation with a CAP Expert

- Your Family’s Financial Aid Eligibility (or lack thereof)

- Learn strategies to maximize free money for college, including grants and scholarships, and uncover hidden opportunities.

- Receive a Clear Next Step

- Get personalized recommendations and discover how our services can help your family reach your college planning goals.

Tool #3: Stay Informed - Free Monthly Webinar Series

Monthly College Planning & Financial Aid Webinars

Keep up with the latest Department of Education updates, financial aid changes, and expert college planning strategies—all in one place. Join our free monthly webinar series to stay ahead of key developments and ensure your family is making the best financial decisions for college.

📅 Live sessions every second Tuesday of the month at 7 PM ET

🎥 Can’t make it live? Register to receive the recording!

Big Changes Ahead: How Dept. of Ed Updates Impact Loans

One of the most significant shifts from the Department of Education will affect student and parent loans. Federal parent loans are becoming a less attractive option, meaning many families will need to explore private student loans instead.

To secure the best rates, now is the time to start improving your credit—and that applies to students, too! Taking proactive steps today can make a big difference in your borrowing options down the road.

📅 Single Registration for All Sessions

💡Step-by-Step Guide to College Planning

🎓 Expert Guidance in Financial Aid & Scholarships

📂 Access to Session Recordings and Resources

Tool #4: "College!" – The Podcast

Tune in for expert advice, insider tips, and real-world insights to guide families through the college planning journey.

College!

Navigating the ever-changing world of college planning—especially with ongoing Department of Education updates—can feel overwhelming. But it doesn’t have to be! "College!" is your trusted source for expert insights, actionable strategies, and the latest financial aid and admissions news.

Whether you're a student, parent, or educator, tune in to stay informed, make confident decisions, and maximize every opportunity. Don’t miss a beat—stay up to date and take control of your college journey!

Tool #5: The Knowledge Vault – Supporting Articles & Deep Dives

Stay informed with in-depth articles and insights on the latest education policies and financial aid updates.

Tool #6: Dept. of Ed. Student Loans Impact - What You Can Do Now

A major change from the Department of Education is impacting both student and parent loans. Federal parent loans are becoming less favorable (and may even be eliminated), which means many families will need to consider private student loans as an alternative.

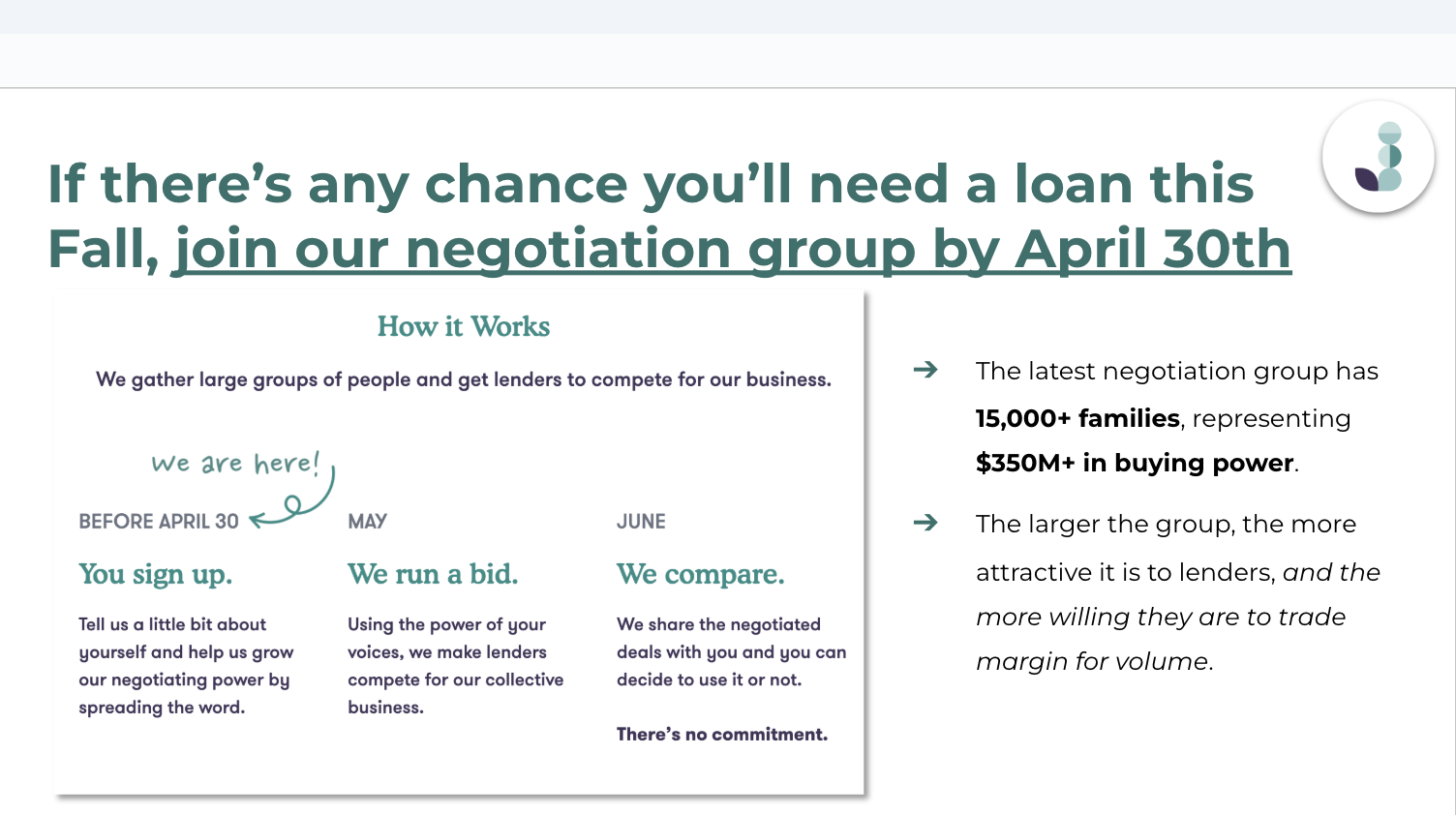

If you expect to need a loan this Fall, take action now with Juno. We’re currently awaiting lenders to provide their rates and terms for the next school year, and we’ll soon share additional recommendations to help you secure the lowest possible student loan rate. Stay tuned for more details!

Join Juno's Student Loan Negotiation Group

Group Bargaining Power:

- No Cost, No Commitment, No Credit Check: Signing up is straightforward and doesn't impact your credit.

- Competitive Rates: Lenders compete to provide you with the most favorable terms available.

How It Works:

1. Sign Up All Year:

Register free by providing some basic information about yourself. This helps Juno grow their negotiating power by spreading the word to others.

2. May:

Juno initiates a bidding process.Using the collective power of our members, Juno compels lenders to compete for their group's business.

3. June:

Juno analyzes and compares the negotiated offers.

You receive the best offers tailored to your credit profile.There's no obligation to accept any offer.

Tool #7: State of The Union Webinar Recording

🎥 State of the Union: Dept. of Ed Policy Changes

Contact Us:

✉️ support@collegeaidpro

.png?width=1400&height=1400&name=Podcast%20Profile%20(slogan).png)